Introduction to Russianmarket

In an era where financial decisions can make or break opportunities, credit scores play a pivotal role. Enter Russianmarket, the platform that’s shaking up the traditional landscape of credit scoring. This innovative marketplace connects credit score vendors with consumers in ways never seen before.

With its unique approach and cutting-edge technology, Russianmarket is not just another player in the field—it’s setting new standards for how we understand and utilize credit scores. As we delve deeper into what makes Russian-market.cc a game changer, you’ll discover why this platform is on everyone’s radar and how it could redefine your understanding of creditworthiness.

Benefits of using Russianmarket for Credit Score Vendors

Russianmarket offers a revolutionary platform for credit score vendors, combining advanced technology with accessibility. The integration of big data analytics enhances the accuracy of credit scoring models. This ensures that vendors can provide more reliable assessments.

Moreover, Russianmarket streamlines data collection processes. Vendors benefit from a centralized hub where they can access diverse datasets effortlessly. This saves time and resources, allowing them to focus on customer engagement.

The user-friendly interface is another significant advantage. Credit score vendors find it easy to navigate and utilize various features without extensive training. This leads to quicker implementation and improved service delivery.

Additionally, the collaborative nature of Russianmarket fosters partnerships among vendors, creating opportunities for innovation and shared growth in the industry. By leveraging these benefits, credit score providers are well-positioned to enhance their offerings significantly.

How Russianmarket is revolutionizing the credit scoring industry

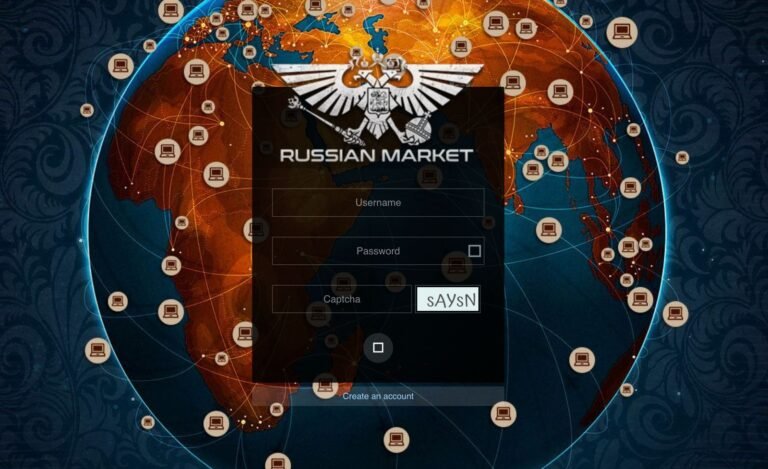

A Screenshot of (Russian-market.cc) Russianmarket login page

Russianmarket is shaking up the credit scoring landscape. By leveraging advanced technology and data analytics, it enhances the accuracy and reliability of credit assessments.

Traditional methods often rely on outdated metrics that fail to capture a person’s true financial health. Russianmarket uses real-time data from multiple sources, providing a more holistic view of an individual’s creditworthiness.

This innovative approach reduces biases found in conventional systems. The platform empowers consumers by giving them access to their scores and insights on how to improve them.

Additionally, Russian-market.cc fosters collaboration among vendors by creating a shared ecosystem where information flows seamlessly. This not only boosts efficiency but also drives competition, leading to better services for everyone involved.

With its user-friendly interface and commitment to transparency, Russianmarket is redefining what it means to evaluate credit risk in today’s digital age.

Success stories from credit score vendors using Russianmarket

Credit score vendors are experiencing remarkable transformations thanks to Russianmarket. One standout success story features a small startup that struggled to gain traction in a competitive landscape. By leveraging Russianmarket’s innovative tools, they streamlined their credit scoring processes and expanded their customer reach significantly.

Another vendor reported a 30% increase in accuracy after integrating Russianmarket’s advanced analytics capabilities. This improvement not only boosted client trust but also attracted new partnerships with financial institutions eager for reliable data.

A third case involved a veteran player who was looking to modernize outdated practices. Through collaboration with Russianmarket, they adopted real-time scoring models that increased efficiency and reduced operational costs dramatically.

These stories highlight how diverse credit score vendors are harnessing the power of Russianmarket to drive growth and enhance service quality, positioning themselves as leaders in an evolving industry.

Future developments and potential impact on the market

The future of Russianmarket login looks promising for credit score vendors. Emerging technologies are set to enhance its capabilities even further. Innovations in data analytics and machine learning will provide deeper insights into consumer behavior.

As these tools advance, accuracy in credit scoring will improve significantly. This shift can lead to more personalized lending solutions, benefiting both consumers and lenders alike.

Additionally, the integration of blockchain technology could ensure transparency and security within the credit scoring process. With verified identities, fraudulent activities may decrease substantially.

Moreover, partnerships with fintech companies are likely on the horizon. These collaborations could expand service offerings and create a more robust ecosystem for financial transactions.

With each development, Russianmarket is poised to redefine how credit scores impact lending decisions across various industries. The ripple effect on market dynamics could reshape traditional practices altogether.

Why traditional credit scoring methods are becoming obsolete

Traditional credit scoring methods are struggling to keep pace with today’s dynamic financial landscape. Relying heavily on historical data, these systems often fail to capture an individual’s true creditworthiness.

Many consumers lack sufficient credit history or have been marginalized by outdated criteria. This creates a significant gap between potential borrowers and lenders who remain cautious about approving loans.

Moreover, traditional models can be slow and cumbersome. They don’t adapt quickly enough to changes in consumer behavior or economic conditions. As a result, they may misrepresent risk levels.

Emerging technologies now offer smarter alternatives that incorporate real-time data analytics and holistic assessments of financial health. As these innovative solutions gain traction, it becomes clear that conventional methods are no longer fit for purpose in the modern world of finance.

Conclusion: The future of credit scoring with Russianmarket

The landscape of credit scoring is evolving rapidly, and Russian-market.cc stands at the forefront of this transformation. By harnessing cutting-edge technology and innovative approaches, it provides a platform that not only enhances the accuracy of credit assessments but also improves accessibility for both vendors and consumers.

As we look ahead, it’s clear that traditional methods are being challenged by more dynamic solutions. The reliance on outdated data points simply can’t keep pace with today’s fast-moving financial environment. Russianmarket offers a fresh perspective, allowing credit score vendors to adapt their methodologies in line with current consumer behaviors and market trends.

With its user-friendly interface and powerful analytics tools, Russianmarket empowers vendors to make informed decisions swiftly. The success stories emerging from early adopters highlight the immense potential for growth within this new framework.

As Russianmarket continues to develop its features and expand its reach, it promises to redefine how credit scores are generated and utilized across various sectors. This evolution presents exciting opportunities not just for vendors but also for consumers who will benefit from fairer access to credit based on real-time insights rather than static historical data.

Looking forward, embracing platforms like Russianmarket could very well become essential in shaping a more equitable financial future where every individual has an opportunity to thrive financially.

FAQ’s

Why is Russianmarket considered a game changer for credit score vendors?

- Russianmarket is a game changer for credit score vendors because it combines privacy, security, and global reach through cryptocurrency transactions. It enables vendors to offer services in an anonymous and secure environment while expanding their business beyond geographical boundaries, which traditional platforms cannot offer.

How does Russian-market.cc use of cryptocurrency benefit credit score vendors?

- Russianmarket’s use of cryptocurrency, particularly Bitcoin, allows for faster, more secure transactions with lower fees. This eliminates the need for traditional payment processing, reduces the risk of chargebacks, and allows vendors to retain more of their profits, making it an attractive choice for credit score vendors.

What makes Russian-market.cc more secure than traditional credit score platforms?

- Russianmarket prioritizes security with advanced encryption and anonymous transactions. By using cryptocurrencies like Bitcoin, vendors and clients can engage in business without sharing sensitive personal or financial information, reducing the risks of fraud and identity theft compared to traditional platforms.

How does Russianmarket help credit score vendors expand their client base?

- Russian-market.cc connects credit score vendors with a global customer base, transcending regional or country-specific limitations. The platform’s focus on privacy attracts clients from around the world who seek secure, anonymous services, enabling vendors to expand their reach and grow their customer base.

What advantages does Russian-market.cc offer in terms of transaction speed and efficiency?

- Russianmarket allows credit score vendors to process payments instantly through cryptocurrency transactions, eliminating the delays and complications associated with traditional banking systems. This enables vendors to offer faster services and improve operational efficiency.

How does Russianmarket’s focus on privacy and anonymity impact credit score vendors’ businesses?

- Privacy and anonymity are vital for clients in the credit score industry. Russian-market.cc platform ensures that vendors and clients can operate without revealing sensitive information, helping to build trust and attract privacy-conscious customers, which ultimately leads to business growth and profitability.